Storm Yield Finance is a DAO and DeFi eco-system offering Auto Staking & Auto Compounding

The StormYield Finance project is a very unique project, and I know many features and properties of the project. So let's see what the project has special.

What service does the StormYield Finance provide?

StormYield Finance (STY) offers a decentralized financial asset that rewards holders with sustainable fixed compound interest income through the use of its unique STY protocol.

Hold to Earn $STY for the Highest fixed APY in Crypto, compounded interest every 5 minu

StormYield Finance unique elements

StormYield Finance is an outstanding staking service with unique elements designed to bring huge benefits to $STY holders.

Secure staking service: 5% of all trading fees are kept in the STY Insurance Fund which helps sustain the staking rewards by maintaining price stability.

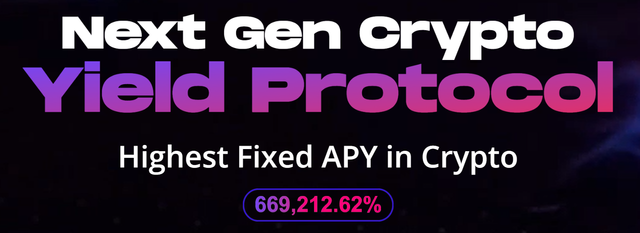

Highest and easiest Staking: Staking with StormYield Finance becomes easier than any others. Investors just need to HOLD TO EARN $STY with the highest APY at 669,212%.

Lighting speed rebase rate and payment: $STY holders will receive a reward every 05 minutes (288 times/day), making STY the fastest auto-compound finance platform in the crypto world.

Auto burn: One of the most unique features is THE LIGHTNING ROD - a progressive burning mechanism. STY Lighting Rod protects the STY protocol by reducing the circulating supply and maintaining a higher STY price over time.

.png)

Auto pairing

How does auto-combine work?

The STY Auto Match feature uses a simple Hold-to-Earn mechanism where you can get rebase rewards as interest payments directly to your wallet just by holding $STY tokens.

STY allows payment of $STY tokens proportional to the reward of the epoch rebase. With Crypto's highest Auto-Staking & Auto Pooling protocol and Industry's Largest Fixed APY of 669,212.62%, all BSC wallets holding $STY tokens receive automatic compound interest rewards 0.00838% value every 5 minutes.

StormYield Finance offers the most innovative, highest and easiest mechanism to profit from staking $STY by applying the power of compound interest.

Lightning rod

Unique progressive $STY burning mechanism

The Illuminated Bar is the STY Protocol's original Write mechanism. 2.5% of all $STY traded is burned in the Lighting Bar.

The more he trades, the more Rod liquidates. In the same way that real-life lightning rods eliminate threats from lightning, the STY Lighting Rod protects the STY Protocol by reducing the cyclic supply thus counteracting back-base active concerns. and keep the protocol sustainable.

.png)

STY Automated Liquidity Tool (SALE)

Liquidity is a pool of funds split 50/50 between the $STY token and the $BNB token, allowing anyone to buy and sell their STY/BNB at any time.

However, you cannot get good prices if there is not enough liquidity in the pool. Therefore, the STY Team designed the STY Automated Liquidity Tool (SALE) to automatically inject more liquidity into the Initial Liquidity Pool.

.png)

How the STY Auto-Liquidity Engine (SALE) works:

Every 48 hours, the SALE will inject new liquidity into the market.

A 4% tax fee for every buy and sell order goes into an Auto-LP wallet. Every 48 hours, our locked-in Smart Contract will take 50% of the stored $STY to purchase BNB at current market price, which combines with the remaining 50% $STY in the Auto-LP wallet to provide a 50/50 weighting of STY/BNB Liquidity.

By periodically adding more liquidity to the LP, the SALE allows $STY token holders to easily buy and sell their tokens any time with little to no market slippage. It also helps combat market fluctuation as well as the positive rebase rewards.

Storm Yield Auto-Liquidity Receiver: 0x1A25be1B836e553625efFe5940eE0bD507B0Ac10

Follow Them On These Links:

Website: https://stormyield.finance/

Telegram: https://t.me/stormyieldglobalchat

Twitter: https://twitter.com/stormyield

Discord: https://discord.com/invite/Q9WAauv78v

Whitepaper: https://stormyield.finance/#Whitepaper

Author

Forum Username: bimbimabimanyu

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443739

BSC Wallet Address: 0xDBFC561A3202DeFB76980c5E9dAB98386e0fcEDb

Comments

Post a Comment