RABBIT FINANCE PROTOCOL DEFI YIELD FARMING (BSC)

introduction

The progress of Blockchain technology has developed very rapidly, this has also had a positive impact on the adoption of the cryptoqurrency market, especially local and private companies, which are taking part in the blockchain industry. Blockchain technology is one of the technologies for the era to come, even most people believe that blockchain technology will be needed in the future. satoshi has created advanced technologies, such as secure payments, improvements in e-commerce, and all cryptocurrencies, bitcoin, etc. One of the factors that plays an important role in the development of any platform is online transactions that are safe, reliable, easily accessible. , and also transparent. Additional costs affect all industrial economies but now all this is possible because of blockchain solutions. The presence of RABBIT FINANCE can give you a big advantage in the crypto market, with a promising concept, quality products, and an experienced team needed in the role of developing blockchain projects. let’s join us!

At present, various kinds of Defi emerge endlessly. However, a one-stop Defi product that can satisfy all kinds of needs is still absent in the market. In this context, Rabbit Finance comes into being.

What is Rabbit Finance?

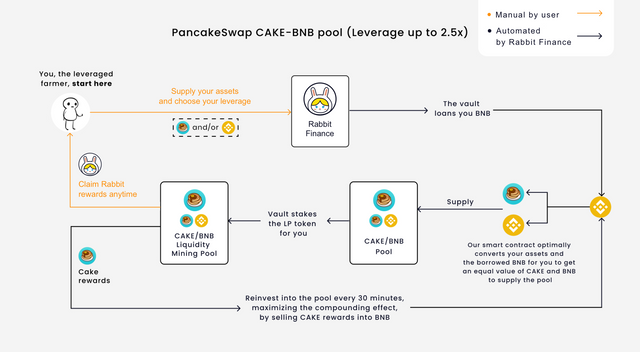

Rabbit Finance is a leveraged yield farming protocol based Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through over-lending plus leverage to get more revenue.

When the user has insufficient funds but wants to participate in DeFi liquidity farming, Rabbit Finance can provide up to 10X the leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

As predecessors of this area like Link, COMP, and BAL are fighting alone, Rabbit Finance, a latecomer, has started to propel resource integration to be the one for all of Defi.

Defi ecology, on the Rabbit Finance, ambitiously included modules like lever gun pool + arithmetic stablecoin, NFT+ arithmetic stablecoin. For Rabbit Finance, they hope to build the Defi ecology through the easy to more advanced and Interlocking combination of functions.

It makes it possible for users to experience the various context of the use of DeFi in a one-stop way, as well as yielding rich returns.

•The feature and value of Rabbit Finance•

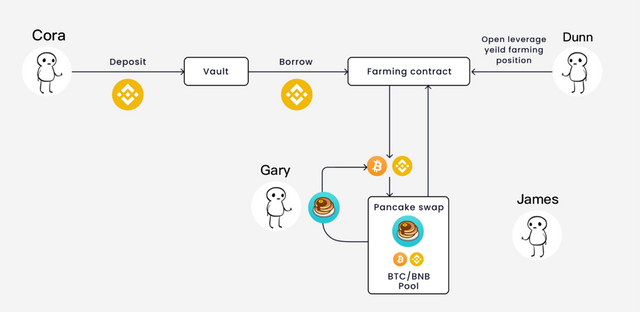

- Cora

the lender deposits his BNB into our deposit vault; his asset becomes available for a yield farmer to borrow; he earns interest for providing this liquidity.

- Dunn

the yield farmer wants to open a leveraged yield farming position on the BTC/BNB pair; he borrows BNB from the vault and enjoys higher yield farming rewards.

- Rabbit

Finance’s smart contract takes care of all the mechanics behind the scenes optimally switching assets to the right ratio, providing liquidity to the pool, and staking LP for Pancake Rewards

- Gary

the liquidator monitors the health of each leveraged position, and when it goes beyond designated parameters, she helps liquidate the position, making sure lenders such as do not lose their capital. For this service, she takes a 5% reward from the liquidated position.

- James

the bounty hunter monitors the amount of rewards accrued in each pool and helps reinvest it back, compounding returns for all farmers. For this service, he takes 0.4% of the reward pool as a reward. 30% as buyback fund, which will be used for RABBIT’ buyback and deflation. The remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns.

Besides, when the bounty hunter pitches on the pool and executes the reinvestment, 30% of the bounty of the pool is used as buyback funds to promote the value of the token.

Why does reinvestment raise the value of the token? This can be explained by the supply and demand relationship in economics. When the demand exceeding the supply, the value of the asset is bound to raise. According to the deflation mechanism of Rabbit Finance, the 30% of reinvestment earnings is used to repurchase fund to realize the continuous deflation of the token. In the author’ perspective, the deflation mechanism of Rabbit will become the vital factor for realizing the price of token. Continuous buyback and dispose make it possible for the volume of token supply to decline on a limited scale. These will drive the token to be increasingly precious. When Rabbit achieves its implementation, the price of the token is expected to rise correspondingly.

The 30% of the bounty of the pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is directly given to the bounty hunter as a reward, the remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns. The huge power gifted by repeated investment makes it possible for investors to make more profits.

Except for the value increase driven by the token deflation, Rabbit has some other values. For example, before Rabbit coming into being, gun pool tokens can do nothing but to govern. However, Rabbit holders can mortgage their stakes to the board to share bonuses. As long as Rabbit Finance is profitable, its holders are given the right to share the bonus as shareholders and make easy money.

NFT (Non-fungible Token) is an emerging niche market for nearly everyone to take his chance. It is predicted by the specialist that NFT has its potential to become one of the world’s biggest market. The authority of the Rabbit has given much thought to its token. Rabbit Finance Lab will continuously empower Rabbit token, for example, Rabbit holders can snap up irregular issued NFT artwork, and the Rabbit will be automatically locked up during this period. Its circulation will be blocked and its value is expected to be pulled up in a short term. Holding NFT can accelerate mining, empowering the NFT with value with the help of Rabbit.

These two parties are of reciprocal relationships, that is to say, holding Rabbit makes it possible for holders hold NFT, the appreciation of NFT token reacts on the appreciation of Rabbit.

What is RABBIT token?

RABBIT token is a governance token of the Rabbit Finance. It will also capture the economic benefits of the protocol. There will be a maximum of 200 million R tokens.

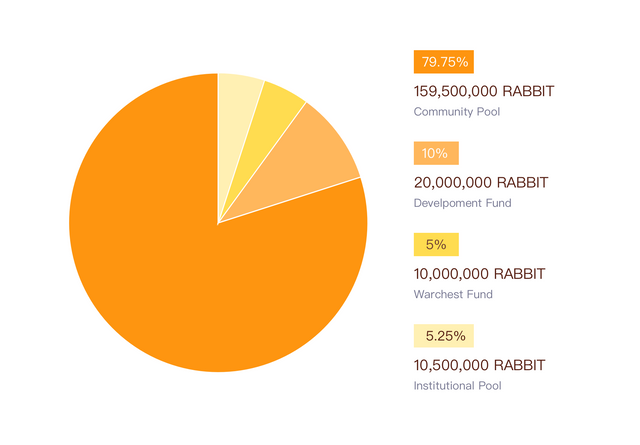

•RABBIT distribution•

- Community Pool

79.75% of total supply,about 159,500,000 RABBIT.

RABBIT will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

- Institutional Pool

5.25% of total supply,10,500,000 RABBIT

Provide 5.25% investment quota for well-known institutions and investors. After the completion of the investment, 245,000 RABBIT will be released every 7 days, and 10,500,000 RABBIT will be released within 300 days (about 10 months). Specific time to be determined, please pay attention to the follow-up announcement.

Hard cap:10,500,000 RABBIT = 525,000 USDT

Exchange ratio: 1 RABBIT= 0.05 USDT

- Development Fund

10% of total supply,about 20,000,000 RABBIT

10% of the distributed tokens will go towards funding development and expanding the team, and will be subject to the same two-year vesting as the tokens from the Fair Launch Distribution.

- Warchest Fund

5% of total supply,about 10,000,000 RABBIT.

5% of the distributed tokens is reserved for future strategic expenses. In the first month, 250,000 tokens were released for listing fees, auditing, third-party services, and liquidity of partners.

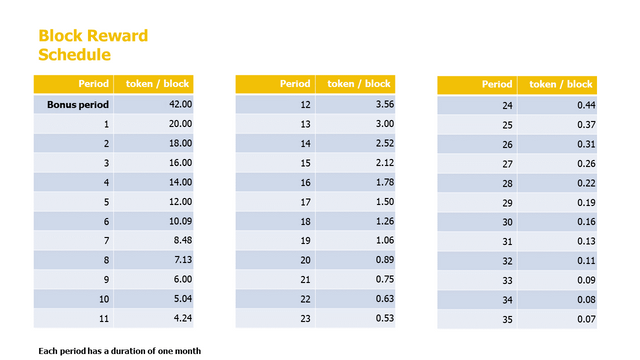

•Community pool release program•

RABBIT token will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

In total, there will be 159,500,000 RABBIT. To incentivize early adopters, there will be a bonus period for the first weeks. Below is our planned block reward schedule. Based on it, the circulating supply profile of RABBIT can be plotted.

•Pools Allocation•

Below are points allocation to each pool which determine the rewards distributed.

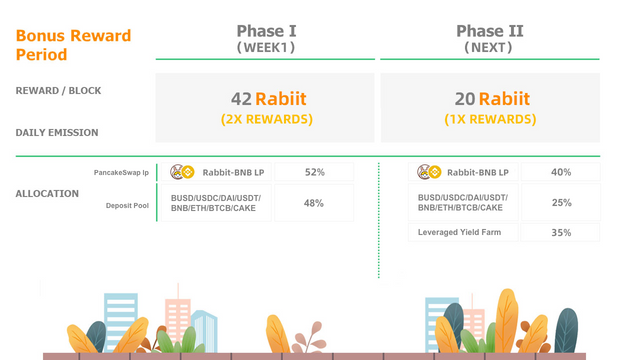

•Bonus Period•

Open deposit vaults & pancakeswap liquidity pool, emission rate: 42 RABBIT /block. It lasts about one week.

•Pools – RABBIT / block•

Deposit Pool: ibBNB – 2.52

Deposit Pool: ibBUSD – 2.52

Deposit Pool: ibUSDT – 2.52

Deposit Pool: ibUSDC – 2.52

Deposit Pool: ibDAI – 2.52

Deposit Pool: ibBTCB – 2.52

Deposit Pool: ibETH – 2.52

Deposit Pool: ibCAKE – 2.52

Pancakeswap RABBIT-BNB LP – 21.84

•Officially Launched•

When leveraged yield farming officially launched, emission rate: 20 RABBIT /block (take this as an example).

•Pools – RABBIT/block•

Deposit Pool: ibBNB – 0.625

Deposit Pool: ibBUSD – 0.625

Deposit Pool: ibUSDT – 0.625

Deposit Pool: ibUSDC – 0.625

Deposit Pool: ibDAI – 0.625

Deposit Pool: ibBTCB – 0.625

Deposit Pool: ibETH – 0.625

Deposit Pool: ibCAKE – 0.625

Pancakeswap RABBIT-BNB LP – 8.0

Pancakeswap USDT-BUSD LP – 0.875

Pancakeswap DAI-BUSD LP – 0.875

Pancakeswap USDC-BUSD LP – 0.875

Pancakeswap USDT-BNB LP – 0.875

Pancakeswap CAKE-BNB LP – 0.875

Pancakeswap BUSD-BNB LP – 0.875

Pancakeswap ETH-BNB LP – 0.875

Pancakeswap BTCB-BNB LP – 0.875

•Words in the End•

From ordinary investors’ perspective, there are high entry barriers to use traditional finance—it’s hard for borrowers to raise a loan, while the providers get low earnings. Rabbit is expected to solve this problem under the context of Defi to give its users high earnings as well as increasing the liquidity of the fund. This is just one kind of benefit and change made by Rabbit Finance to investors. In the future finance world, Rabbit Finance will play a bigger constructive role.

•Join our community•

Related Links

Rabbit Finance website: http://rabbitfinance.io/

Twitter: https://twitter.com/FinanceRabbit

Telegram: https://t.me/RabbitFinanceEN

Discord: https://discord.gg/tWdtmzXS

Contracts info: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Audit report: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

AUTHOR

Forum Username: Vechainz

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2437174

Telegram username: @Vechainz

BSC Wallet Address: 0xCb3bA7E4365C119057E0c7c44cF82ad76Fc22Dcc

Comments

Post a Comment